欧洲创投生态在最近的一年多以来展现出了更加成熟的形态,美国和欧洲的投资人都已经开始加速在欧洲市场的投资布局。本文内容为读者粗略展现了欧洲创投市场的生态、趋势和机会。中国的风险投资机构或许能够有所借鉴。

以下英文内容来自美国著名风险投资机构USV(Union Square Ventures)合伙人Fred Wilson最近的文章和Sapphire Ventures 合伙人Elizabeth Clarkson发表于今年5月份关于欧洲创投市场的分析文章。

网易创业Club对这部分内容的主要信息进行中文提炼,英文部分全文保留但不做翻译,建议读者自行阅读。

Fred Wilson的投资案例包括:Twitter, Tumblr, Foursquare, Bug Labs, Meetup, Zynga等。他同时还是著名博客AVC的作者。

Sapphire Ventures在全球范围内进行风险投资,B2B领域是其专长。同时,Sapphire Ventures还是欧美多家VC的LP(有限合伙人)。

Sapphire Ventures以LP的身份从宏观的角度分析了欧洲创业投资生态系统的前景和趋势;USV则以VC的身份从微观实践的角度说明了同样的问题。

·欧洲创投生态迅速成熟

Sapphire Ventures是美国、欧洲、以色列多家风投基金的LP,所以他们对于欧洲创业投资的生态系统非常了解。

作为LP,Sapphire Ventures在过去的一年半里的承诺出资额中有1/3的比例给了欧洲的新基金。

作为VC,USV目前全部的持股portfolio公司中有22%来自欧洲。在2015年内,USV所投资的9个标的企业中有4家来自欧洲。

对比老牌风投聚集的硅谷,欧洲的风投公司普遍比较年轻。2008年之后,欧洲涌现出了大量的创投孵化器和加速器。随着移动互联网的普及,欧洲的创业公司也不断涌现。

在过去5年里,欧洲新出现的10亿美元级估值创业公司为24家;风投资金退出额达到了240亿美元。

·跨文化背景创业团队瞄准全球市场

欧洲主要的创业公司集中区域有三个:伦敦、柏林和斯德哥尔摩。它们分别代表了英国、德国和斯堪的纳维亚半岛的创业生态。

2014年,英国、德国和北欧国家发生的风投案子数目分别是225、154、113,三地交易数占欧洲总交易数一半以上。

在这种背景下,欧洲的创业文化、创业精神和人才储备开始加速增长。

这些欧洲公司的创始团队具备国际视野,如果模式得当,他们的目标市场可能会同时瞄准欧洲、北美、南美甚至亚洲。

中国国内的VC机构也在开始提出未来的很大一个创业方向是面向海外的。其实,对于VC自身而言是不是也是如此呢?

·欧洲市场对于VC和LP的价值

2014年,美国新募集基金为87支而欧洲为19支。尽管欧洲创投生态在快速成熟,但欧洲创投基金之间的竞争烈度仍然相对美国要小。这意味着欧洲项目的投资机会和性价比可能会更高。

我们观察到,中国的风投机构已经发生了明显的行为转变。对创始人友好、重视投后管理、向倍投企业提供真实增值服务在最近几年迅速成为VC的主流策略。在欧洲,这个代际行为的转化趋势也在同一时间迅速的发生着。

对于优秀创业者而言,他可以较以往更加从容的选择真正适合自己的投资人。对于具备国际视野的创业者和风投,彼此都应该更加关注跨境网络资源、解决难题经验以及迅速行动的能力。

对于LP而言,同时在美国、欧洲、以色列、中国布局可以非常清晰的感知到全球各地的商业模式、用户喜好、估值趋势并站在更高的视野上帮助VC完成投资。

·VC进入欧洲市场的策略

对于希望在欧洲展业的VC而言,首先在当地需要投出两个有代表性的案子,有了刷脸的资本是未来扩充业务的基础。

跨境做生意很多时候讲求合作,合资企业就是这么来的。对于VC生意而言,在进入新市场时这也是很正常的策略。可以通过联合当地或者熟悉的机构合作几个案子作为切入手段。

像老牌美国VC进入中国时让本土投资团队挂牌子自由发挥的做法类似,欧洲市场上也在出现这类似的玩法。这或许也是可以考虑的“外包”模式。

重要的是,现在在欧洲创投市场上的VC资金还仅仅是美国市场资金量的1/100。单纯从这个数字就应该可以感知到机会背后的安全边际有多大了。

注:本文数据来自英文原文,未经验证。

-------------------------------------------------------------------------------------------------------

A Closer Look At European Investing

Elizabeth Clarkson

We’re bullish on Europe, and that strikes some folks in the U.S. as a bit strange. It’s not that Europe is all we know — we’re an investor in early venture stage funds (an “LP”) in the US, Europe and Israel. Our portfolio skews towards the U.S.; and within the U.S., to the Bay Area. But over the last 18 months or so, we’ve been crossing and re-crossing the Atlantic with increasing regularity, and in that time frame European venture funds constitute more than a third of the funds to which we have committed.

Specifically, in the last 18 months we have invested in 83North, Mosaic and Point Nine — and we are working on three additional funds yet to be announced. Given how early in their investing cycles these new funds are, as well as other funds we have invested in previously, it is too soon to be making any calls. To answer the question, then, as to what makes Europe so compelling, we have to take a more macro perspective.

The Burgeoning European Startup Ecosystem

Silicon Valley is a mature startup ecosystem — some 50+ years old. Europe, on the other hand, is younger, and has recently passed a few key inflection points. In our opinion, the European ecosystem is currently entering v 3.0, or maybe v 2.5 if you want to be more conservative, given the recent stock market rollercoaster and Grexit situation. In either case, it is ripening.

Some history to put this in perspective: v 1.0 started in the 2000s when things were getting off the ground. Then, v 2.0 in about 2008, whose poster child surely has to be Rocket Internet. Following their success, a wave of accelerators and incubators rolled out across Europe; at the same time, the number of startups spiked.

The net effect was a crash course in what it means to be part of a rapidly growing startup ecosystem. And with each company, successful or otherwise, the European startup ecosystem deepened and broadened, and entrepreneurship became an increasingly accepted career path, along with producing more experienced entrepreneurs, engineers, managers, marketers, investors, consumers and service providers.

There are now some 40 European unicorns, 24 billion-dollar exits over the last 5 years and some 641 companies have raised more than $6 billion in H1 2015 alone. This is up from 738 deals and $5.1 billion for all of 2011. Like in the U.S., Europe now boasts multiple hot spots for innovation, with London, Berlin and Stockholm leading the pack. In these cities you find a concentration of talent, dollars and lighthouse venture-backed companies.

We believe European entrepreneurs today are more experienced, think bigger, have global ambitions and are attracting capital at home and abroad. Leading U.S. funds (Sequoia, Union Square, Andreessen Horowitz and NEA, to name only a few) are investing in European companies, lest they miss out on all the fun.

Innovation Knows No Boundaries

We believe great ideas can — and do — start anywhere. Today’s entrepreneurial ecosystem is increasingly porous, with companies often starting in one European country, then moving to London, Berlin or the U.S. as they grow, attracting capital and teams.

Some European companies will come to the U.S. to scale and be closer to their U.S. customers. Others will stay in Europe, taking advantage of the ever-increasing local talent pools, lower cost of living and the flattening of the world. We also see U.S. tech companies moving to Europe in their own pursuit of European customers — both private tech companies and massive public ones like Google, Facebook, Cisco, eBay, etc.

There are three European ecosystems we watch, in particular, and have focused our fund investment activity: the U.K. (London), Germany (Berlin) and the Nordics (Stockholm). We track them because of their high levels of new company formation, value creation and exits. In 2014, the U.K. and Germany attracted the highest number of deals throughout Europe, 225 deals and 154 respectively, accounting for 44 percent of all European VC-backed tech deals. When you look at the Nordic region as a whole, you get some 113 deals.

As far as company valuation, the U.K., Sweden and Germany (in that order) are currently home to the most-billion dollar+ valued companies. Lastly, on the exit side of the equation, the U.K. has garnered the lion’s share of billion-dollar exits. Of the 24 companies achieving billion-dollar exits over the last five years, five were from the U.K., the highest number from any one region. Ireland and Germany were tied for second place, with four companies with more than a billion-dollar exit value each.

Competition. U.S. venture is a competitive sport, with many well-established brands battling to invest in the best companies, as well as an ever-increasing host of new emerging managers. Q1 2015 alone saw an additional 36 new U.S. funds come to market, on top of 87 new funds in 2014. While Europe is also seeing a rise in the number of new venture funds coming to market, there are significantly fewer; seven in Q1 2015 and 19 in 2014.

The Power Of The Global Observatory. By investing in multiple geographies, an LP has a front row seat simultaneously to numerous high-tech markets. Sapphire Venture invests in the U.S., Europe and Israel. If we pay attention, we can see patterns emerging, trends in company formation, customer traction, valuations and the corresponding responses by venture capitalists. With this perspective, we believe we can be a more informed investor, and that much more valuable as advisors to our GPs as they compete on an ever-globalizing stage.

The Future Does Not In Fact Always Look Like The Past. Multiple top venture funds today were just starting 10 years ago, some even more recently than that. Sapphire Ventures believes “emerging managers” play a pivotal role in refreshing the venture community. Not surprisingly, we also believe European venture firms are evolving, as well — with many new firms launching in the last three years alone — 83North, Connect, Felix Capital, Hoxton, Lakestar, Mosaic, Point Nine Capital and White Star … and the list goes on, complementing the existing established players.

There is a notable generational shift going on within European venture funds to a more founder-friendly, value-add perspective similar to their U.S. counterparts. The best entrepreneurs have their choice of investors, and will choose those that have cross-border networks, company building know-how and those that can act quickly.

---------------------------------------------------------------------------------------------------------------------

The European Startup Market

Fred Wilson

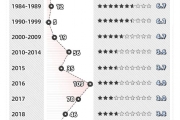

At USV, we’ve been investing in European startups since 2008. Currently 22% of our active portfolio is in Europe. Since 2010, we’ve invested in 47 companies (roughly 8 per year) and 11 of them have been in Europe (roughly 2 per year). So over the past six years, roughly 25% of our investments have been in Europe. In 2015, we have made nine investments to date (a few have not yet been announced) and four of them have been in Europe (45%).

So what’s happening here?

Well first, we have developed an investment presence in Europe. While we don’t have an office in Europe we do have fourteen portfolio companies and every USV partner has at least two European portfolio companies. So we all travel to Europe regularly and we look at new investments when we are over here.

Second, we have developed a number of strong relationships with European venture capital firms. Serving on boards with other VCs is the number one way you build relationships in the VC business and we’ve done a lot of that with European VCs.

Third, European entrepreneurs have, for the most part, abandoned the approach of building domestic businesses in their home markets and are now targeting global customer bases from day one. That means the potential scale of European startups is as large as US startups.

Fourth, there has been a wave of new European VC firms started in the past couple years. Most of these VCs got their start in older legacy VC firms and they are now opening up shop on their own and operating in a more entrepreneurial “silicon valley” style. This reminds me very much of the period ten years ago in the US when USV, Emergence, Foundry, Spark, First Round, and a number of other high quality VC firms opened their doors in the US.

Fifth, European entrepreneurs have made money for VCs. There have been 24 billion dollar plus exits in Europe in the last five years.

When you take all of that and combine the fact that there is probably a hundredth of the VC dollars at work in Europe vs the US, you get a great market to invest in.